- THE SCOOP

- Posts

- We have new partners + Do Kwon Arrested In Montenegro👮♂

We have new partners + Do Kwon Arrested In Montenegro👮♂

Welcome to another edition of The Scoop. The Scoop is that feeling you get when you imagine being the tipster that spots Do Kwon at the airport and sees right through his fake documents.

The Big Scoop

The regulatory spree that authorities happen to be on with regard to cracking down on crypto just keeps raging on. We know what you’re thinking. “Cracking down on crypto during this recessionary journey that we’re on in the world is totally cringe dude”.

That’s a fair point for you and the voice we imagine you have talking back to us, but not all of the scrutiny is bad. For one, international authorities arrested Do Kwon at an airport in Montenegro last week despite the fact that he had several fake documents on his person.

The Terra Luna founder saw his $40 billion project collapse last year and his arrest brings to a conclusion the 320 days of freedom he’s had since then.

In other law enforcement-related crypto news, Coinbase is facing charges from America’s Securities and Exchange Commission, and it's causing hesitation among centralized exchanges everywhere… And also, celebrities like Lindsay Lohan, Jake Paul and Soulja Boy who have used their clout to cash in and are also now facing charges (and Tron founder Justin Sun too!!!...damn that’s a lot of notable people in trouble)

Ultimately in the long run, increased regulation will lead to institutional investing in crypto which will (hopefully) make all of us rich. Perhaps that’s part of the reason why Bitcoin is still up big on the year despite all the regulatory and macroeconomic concerns crypto and Web3 is dealing with.

Crypto might also be up big because Arbitum’s airdrop happened and people are now richer for having used Layer 2.

More on all of this to come in the news…

The Bitcoin Bet: Day 12

Not sure if all our fellow Scoopers have been following along, but we have been following a serious bet that has been hitting the web like fire, let us give you the scoop!

Balaji Srinivasan, a former CTO of Coinbase, has placed a $2 million bet that Bitcoin would hit the $1 million price mark in 90 days. This bet was in response to financial expert James Medlock who proposed a $1 million bet that the US would not enter hyperinflation despite the recent collapse of banks in the country.

Will Hit $1 Million In 90 Days? Will Balaji win the bet? The Scoop will be tracking this!

The News

The Long Arm of the Law Cracks Down on Do Kwon, Justin Sun, Coinbase, Lindsay Lohan, Soulja Boy…and Probably More

Sooo… a series of legal dramas has unfolded in the world of crypto.

First off, Terraform Labs founder Do Kwon is in hot water. Charged with forgery in Montenegro, he's set to appear in court for extradition proceedings. Remember the collapse of stablecoin terraUSD last year? Yup, that's the guy. He's been on the lam ever since, but got nabbed at Podgorica airport alongside another individual.

It's not just Do Kwon, though. This year, government watchdogs are taking a closer look at the crypto industry, with big names like Coinbase, Tron, Lindsay Lohan, and Soulja Boy feeling the heat. The SEC has taken an especially keen interest in the industry, and it's putting a damper on Bitcoin's rally.

The legal showdown between the US government and crypto believers has intensified since the failure of Terra blockchain's stablecoin and FTX's bankruptcy last year, which wiped out nearly $2 trillion of digital wealth. Add to that the recent meltdown of crypto-friendly banks Silvergate Capital Corp. and Signature Bank, and it's clear we're in for a wild ride.

At the heart of the matter is the SEC's decision to treat many crypto assets as securities, subjecting them to strict regulations. This has left the crypto community fuming, particularly in the case of Coinbase, which claims it's tried to engage with the SEC to no avail.

Those targeted by the SEC have a choice: settle or fight it in court. Coinbase CEO Brian Armstrong has made it clear they'll fight the complaint, alleging that the SEC hasn't been fair or reasonable in its approach to digital assets.

As for the celebrities caught in the crossfire, six of the eight involved – including Lindsay Lohan and YouTuber Jake Paul – have chosen to settle with the SEC. They were accused of promoting coins traded on the Tron blockchain without disclosing they were being paid. Rapper Soulja Boy and singer Austin Mahone, however, haven't settled, and they're keeping pretty quiet about the whole ordeal.

The case against Justin Sun and three of his Tron-related companies goes beyond dealing in unregistered securities. They're also accused of fraud and market manipulation through over 600,000 alleged wash trades. Sun, however, insists the SEC's complaint is baseless.

Do Kwon's indictment in the US suggests that the Terra blockchain project collapse wasn't just a $60 billion accident. Prosecutors allege he engaged in market manipulation and deceived investors. Kwon's US lawyer has yet to comment.

So, what's next for the crypto world? Duke University finance professor Campbell Harvey believes we'll see more enforcement news like this due to the current regulatory environment. But crypto optimists like Aaron Brown, a Bloomberg Opinion writer, advise focusing on the future instead of dwelling on the past week's drama.

Keep an eye on the new players who will lead the next boom, he suggests. After all, many of the recent events are merely the aftermath of the storm.

Web3ers Claimed 42 million $ARB tokens in 60 Minutes Last Thursday

The much-hyped Arbitrum token airdrop that went live last Thursday. According to Nansen data, more than 42 million $ARB tokens were snatched up in the first hour alone! That's some serious speed if you ask us

Now, let's get into some numbers. Around 23,000 individual wallets got in on the action, claiming the airdrop. Although that might sound like a lot, it actually only represents about 3% of all eligible wallets. So there's still plenty of room for more people to hop on board.

For those who are wondering, ARB has a total supply of 10 billion tokens, as stated in the technical docs. At the time of the drop on Thursday, it was trading at just over $1.30. Not too shabby, right?

However, not everything was smooth sailing. Arbitrum's website and blockchain scanner faced some issues ahead of the ARB token claim event, as massive interest from token users brought it to a standstill. Users were greeted with a message saying, "This Serverless Function was rate limited." Talk about a buzzkill!

But don't worry, the long-awaited Arbitrum token finally made its market debut on Thursday. With trading kicking off at $3.99 on Uniswap, the token's volatility spiked on decentralized exchanges. At the time of this writing, the project’s token now ranks in the top 40 by market capitalization and is valued at well over $1 billion.

News Flash

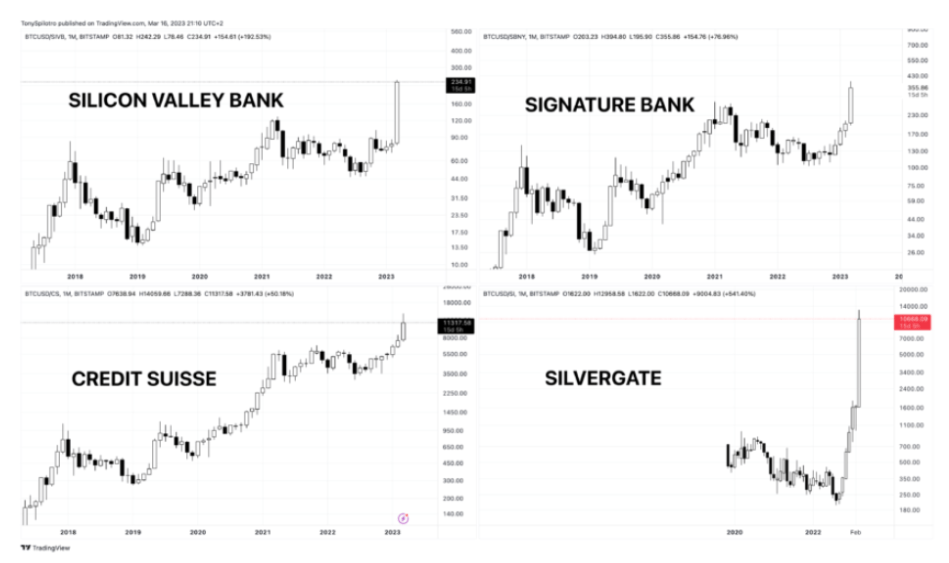

Chart.

Here’s a look at how crypto has been performing against major banks you’re probably very familiar with by now…bling bling💵. Thanks to NewsBTC…

The Chart section of The Scoop is for everyone who prefers to listen to audiobooks or fill-in colouring books over text-based reading. Feast your eyes🍗👀

Market Analysis:

Ok, we have some amazing new developments when it comes to everything crypto markets related!

Our good friend Ashton, Founder of the Crypto Coin Show will be adding value to The Scoop by providing recaps of the Crypto Market!

The Scoop will be a great way for you to get a quick recap of the markets, but for more in-depth details we highly suggest you also follow his newsletter for all your investors reading this!

Subscribe to The Crypto Coin Show Insider

Let's get right into his first market analysis...

Will Bitcoin and Altcoins end March on a high note?

On the 12-hour chart, Bitcoin still shows a buy signal, but it has been losing strength over the past two weeks following an incredible 35% rally. Analysts anticipate a drop-down to 26k or 25k in the near term before the next leg up; however, due to the popular consensus that a downward move is next, Bitcoin could experience upside volatility to liquidate leveraged short positions and continue its upward trajectory. We shall see!

Despite all the FUD (Fear, Uncertainty, Doubt) this week, including banks' ongoing issues, Coinbase and Binance facing lawsuits, and Do Kwon's arrest, Bitcoin has barely reacted to this short-term negative news, which is a positive sign.

Regardless of whether there's a dip, Bitcoin appears poised for a strong April, with positive trends on the 1-day chart and longer timeframes. If BTC does break above $28,900, reaching 30k+ on the same day is entirely possible.

Bitcoin Dominance / Altseason:

BTC dominance is also peaking after the last Bitcoin run and could be heading back down. This means if Bitcoin continues to move sideways, altcoins may have another leg up. With excitement in the industry following the Arbitrum airdrop, altcoins could see significant gains in the coming weeks. Ideally altcoins will rise if BTC drops back towards 43% dominance.

For more insight please Subscribe to The Crypto Coin Show Insider

Education.

We have a special education portion for all your Scoopers this week! This weeks education is brought to by Lachlan, from Multichain Media. Please give Lachlan a big warm welcome!

Hey everyone, I'm Lachlan from Multichain Media and I’ll be explaining a core concept of DeFi: liquidity pools!

In traditional financial markets, market makers play a crucial role in ensuring that there is enough liquidity for traders to buy and sell assets. Market makers are entities that constantly buy and sell assets to provide liquidity to the market., making a profit through buy/sell spreads.

However, in the world of cryptocurrency, the absence of market makers and the low trading volumes on many decentralized exchanges (DEXs) mean that traders often have to deal with significant price slippage. Price slippage occurs when there is not enough liquidity in the market to fill a trader's order at their desired price, resulting in the order being executed at a worse price. This is where liquidity pools come in.

Those with idle assets can pool together pairs of assets to form liquidity pools, becoming liquidity providers (LPs) in turn. In the above graphic, we see LPs depositing ETH + USDC into an ETH/USDC liquidity pool. Each asset pair has its own liquidity pool, with varying amounts of liquidity within them. LP tokens are provided to these LPs, representing ownership over a percentage of the liquidity pool’s assets. As the liquidity pool grows in value, so too should the value of the LP tokens.

On the other hand, traders go to a DEX interface such as Uniswap or Curve in order to swap assets. Our example shows USDC being swapped in exchange for ETH, with a small trading fee (0.3% on Uniswap) being paid to LPs as compensation. In order to maintain a balance of assets within a liquidity pool, pricing changes algorithmically through what’s known as automated market makers (AMMs). Price changes incentivize arbitrageurs to trade the opposite way, bringing assets back to parity.

The beauty of this is that traders may trade cryptocurrencies in a decentralized manner while liquidity providers earn a passive income by contributing their funds to the pool. Liquidity pools are therefore an essential component of DEXs and are key to enabling cryptocurrency trading without intermediaries.

I hope this explanation has been helpful, and thanks for checking out The Scoop!

Scoop Meme

The Final Scoop

Alright, so a lot of people are in trouble these days, but if you’re keeping your data yourself and getting paid for it thanks to Cirus, you’re probably not one of them.

The good news is that a lot of what we’ve covered in the news this week is really just following things that have already happened. The Coinbase bit might have far-reaching consequences but odds are they’ll continue to do business from other countries and still serve people around the world just like Binance and other exchanges have done before, which means it probably won’t affect you in the long run that much.

Ultimately seeing people face the music is better for the industry as a whole, and if all you care about is the building continuing and watching numbers go up, then you’re winning anyway because that still happening and the broader macroeconomic environment that’s crushing all these centralized banks right now is actually good for crypto.

In fact, it’s probably the best piece of public relations crypto could ever get. Never forget that crypto was launched after the 2008 financial crisis, and the one that we are currently experiencing is only going to see crypto and Web3 rise from the ashes.

Share The Scoop

Sharing The Scoop with your friends and family is like giving them an airdrop they weren’t expecting. They get first-class knowledge and they can get tokens just for downloading the Cirus Google Chrome Extension. No need to meet a long list of criteria or mess around with Layer 2 solutions.

Please do share it because we love you and you want to keep helping you protect your data and your money. Especially during these crazy times we’re living through.

See you next time.